Mission

Empowering families to achieve financial peace by providing personalized coaching to prepare for the future, build wealth and leave a family legacy for a secure tomorrow.

Values

I believe in honesty, integrity, accountability and being good stewards of God’s gifts. I believe everyone should be treated with respect and dignity and should not be judged for mistakes they have made. After all… we are all human.

Goal

My goal is to empower couples to work together to achieve their financial goals and win with their money so that they can have peace of mind and provide a lasting legacy for their family.

My Story

I’m TJ Recinella, a financial coach passionate about helping couples and individuals build financial security—saving for emergencies, eliminating debt, and planning for the future with confidence.

My own journey changed in 2005, when tragedy struck. Just six months after our first child was born, my wife and I lost her parents in a car accident. Overnight, we faced not only grief but also the responsibility of managing their estate and caring for my wife’s sister. In that moment, we realized we weren’t financially prepared for an emergency. We never wanted our children to face that same uncertainty—without care, stability, or a plan.

Through prayer, the support of our church, and a commitment to proven financial principles, we created a clear plan. Over time, we built a fully funded emergency fund, paid off over $300,000 in debt (including our mortgage), funded our children’s education, and began saving for retirement. Most importantly, we found peace and freedom, knowing our family was secure and that we were honoring her parents’ legacy.

Today, that experience fuels my calling to guide others. I help couples who earn well but feel stuck, move from surviving to thriving—so they can dream big, live free, and create a secure future for their families.

Dream Big. Live Free.

What a Financial Coach Does

A financial coach helps individuals and couples gain control of their money, create clear goals, and build lasting habits that lead to financial freedom. The role isn’t just giving advice—it’s guiding you through tough decisions, offering encouragement, and holding you accountable along the way.

Here’s how I help:

- Budget Creation – Break the paycheck-to-paycheck cycle with a monthly plan that aligns with your goals, dreams, and values.

- Debt Freedom – Use proven strategies like the debt snowball to eliminate debt and free up money for your future.

- Saving & Planning – Build an emergency fund, prepare for retirement, fund your children’s education, and create a plan for the bigger dreams—whether it’s a home on the lake or a lasting family legacy.

- Financial Education – Learn simple, practical principles that work. Like many, I once thought I had it all figured out—until tragedy revealed how unprepared we really were. I teach what I wish I had known sooner.

- Accountability – Stay on track with someone who will encourage you, challenge you, and make sure you follow through—because we all need someone besides our spouse to keep us honest.

- Support Through Life’s Challenges – From marriage or buying a home to job loss or grief, emotions can cloud financial decisions. I help you step back, see clearly, and make wise choices when it matters most.

At its core, financial coaching is about more than numbers—it’s about peace, freedom, and confidence for your family’s future.

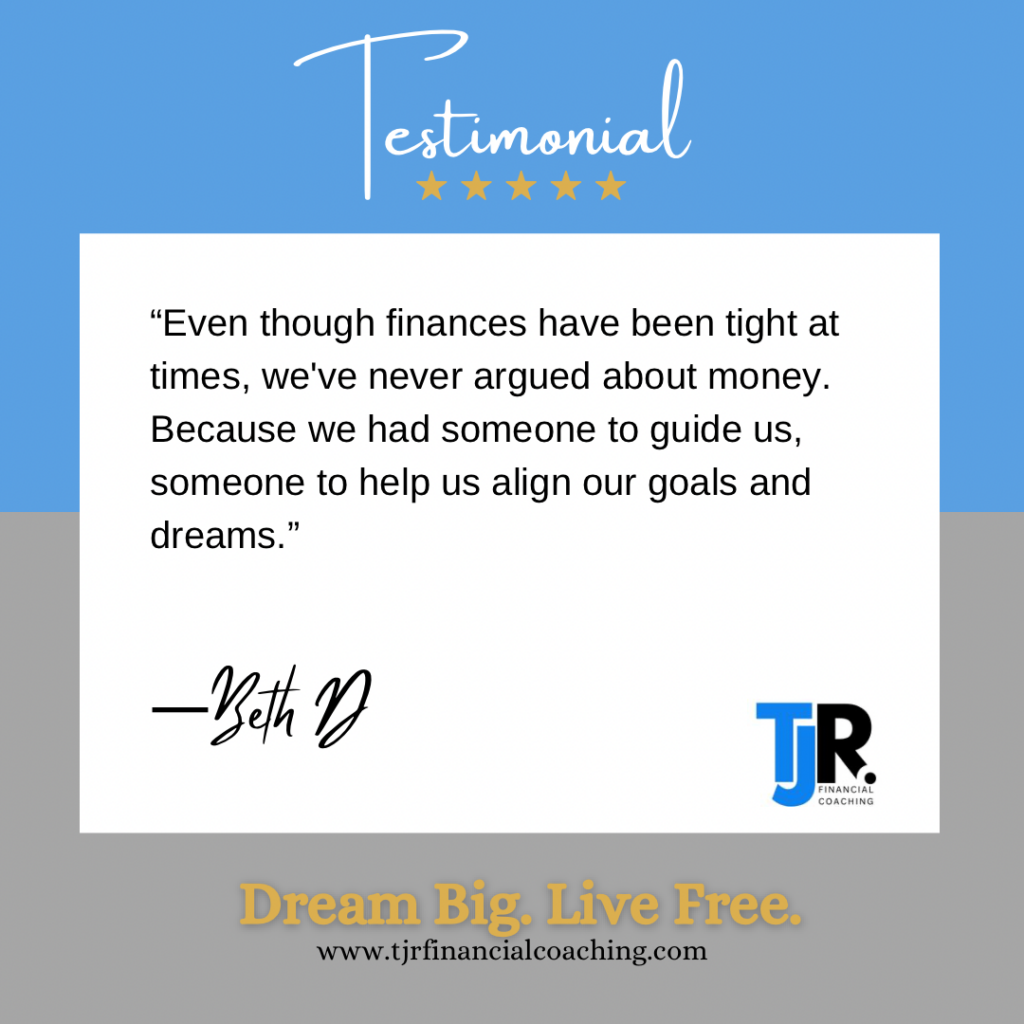

Testimonials

See what people are saying about their transformation stories…